Call Today For a Free Demo: 303-309-1218

Email: info@smarterpos.net

The Best POS System Sales, Installation & Support

Welcome to Smart POS Colorado

Serving the hospitality industry for over 20 years, we are your local one stop shop for all restaurant, bar, quick service and retail point-of-sale POS systems in Colorado. We will successfully implement any POS configuration imaginable for your unique business. As hospitality professionals, we are dedicated to anticipating and exceeding you and your customer’s needs.

Serving the hospitality industry for over 20 years, we are your local one stop shop for all restaurant, bar, quick service and retail point-of-sale POS systems in Colorado. We will successfully implement any POS configuration imaginable for your unique business. As hospitality professionals, we are dedicated to anticipating and exceeding you and your customer’s needs.

We pledge to provide you with the best products, service and price guaranteed.

Our local 365x7x24 support is unmatched in the industry.We install and connect point of sale systems spanning all restaurant segments:

- Quick Service POS System

- Fine Dining POS System

- Bar & Nightclub POS System

- Venue POS System

- Delivery & Takeout POS System

- Hotel & Resort POS System

- Casinos POS System

- Multi Unit establishments POS System

Smart POS will provide the most reliable and easy to use Point of Sale system and credit card processing services at the best price with superior service and support.

Call now to schedule a free demo: 303-309-1218

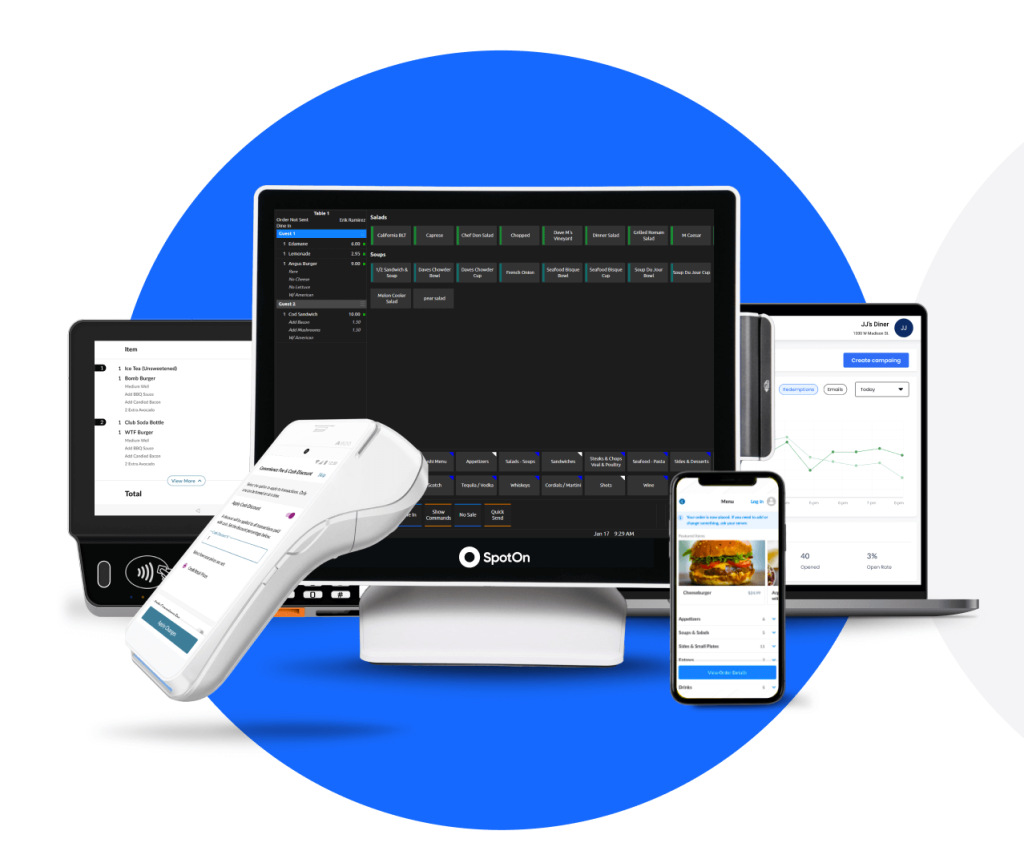

Designed as a turnkey solution that can grow with your business, Smart POS offers everything you need to efficiently and effectively manage your business. Smart POS can provide integrated time and attendance, integrated credit card payments, gift card & loyalty, inventory control, table side ordering & payment, real time alerts, mobile management & a robust back office to help increase revenue, cut costs & boost your bottom line.

Designed as a turnkey solution that can grow with your business, Smart POS offers everything you need to efficiently and effectively manage your business. Smart POS can provide integrated time and attendance, integrated credit card payments, gift card & loyalty, inventory control, table side ordering & payment, real time alerts, mobile management & a robust back office to help increase revenue, cut costs & boost your bottom line.

Smart POS has over 20 years experience meeting and exceeding the needs of customers in all hospitality environments. Bring your business to the next level of efficiency and profitability with Smart POS.

Call us today at 303-309-1218 or email us to schedule a Demo.

Blog Posts are Below:

Category Archives: Credit Card Processing

EVO Payments Inc: Credit Card Processing in the Hospitality Industry

In this blog post, we’ll take a closer look at credit card processing in the hospitality industry, and how EVO Payments Inc. can benefit small businesses. Credit card processing is a crucial aspect of any business, especially in the hospitality industry where customers expect to be able to pay with their credit cards. One of the most popular credit card processing solutions for small businesses in the hospitality industry is EVO Payments Inc.

Credit Card Processing in the Hospitality Industry

What is EVO Payments Inc.?

EVO Payments Inc. is a leading credit card processing company that offers a range of solutions for small businesses in the hospitality industry. It is known for its fast and secure payment processing, which helps businesses increase revenue and improve customer satisfaction.

Fast and Secure Transactions

One of the most significant benefits of using EVO Payments Inc. for credit card processing is the speed and security of its transactions. EVO Payments Inc. uses the latest encryption and tokenization technologies to ensure that all transactions are safe and secure. It also offers fast authorization times, which means that customers can complete transactions quickly and easily.

Flexible Payment Options

EVO Payments Inc. offers a range of payment options to help small businesses in the hospitality industry meet the needs of their customers. It allows businesses to accept all major credit and debit cards, as well as contactless payments, such as Apple Pay and Google Wallet. This helps businesses accommodate customers who prefer to pay with their mobile devices, which is becoming increasingly common.

Integration with POS Systems

EVO Payments Inc. integrates seamlessly with many of the leading POS systems used in the hospitality industry, including SpotOn, Maitre’d, EVO Payments, and Squirrel Systems. This makes it easy for small business owners to manage their transactions and track sales, inventory, and other important metrics.

How Smart POS Can Help Your Small Business

At Smart POS, we understand the unique needs of small businesses in the hospitality industry. That’s why we work with you to customize a credit card processing solution that meets the specific needs of your business. We offer comprehensive installation and support services to ensure that your system is up and running smoothly from day one.

Hardware and Software

We offer a range of hardware and software options to ensure that your credit card processing system is tailored to your needs. Our hardware options include everything from traditional cash registers to touchscreen terminals, and we can help you choose the best option for your business.

CC Processing

We also offer comprehensive CC processing services to help you manage transactions quickly and easily. Our CC processing solutions integrate seamlessly with EVO Payments Inc., allowing you to accept payments in a variety of ways, including contactless payments.

Service and Support

At Smart POS, we know that downtime is not an option. That’s why we offer comprehensive service and support to ensure that your system is always up and running. Our team is available 24/7 to help you troubleshoot any issues and ensure that your business is always operating at peak efficiency.

Credit Card Processing in the Hospitality Industry: Conclusion

In conclusion, small businesses in the hospitality industry require a reliable and efficient credit card processing system that can manage transactions and help streamline operations. EVO Payments Inc. is one of the most popular credit card processing solutions for small businesses in the hospitality industry, and it offers a range of features that help small business owners manage their businesses more efficiently.

At Smart POS Inc, we are committed to providing the best installation, support, and maintenance services to help you get the most out of your credit card processing system. Contact us today to learn more about our range of credit card processing solutions and POS systems and services, including EVO Payments, SpotOn, Maitre’d, and Squirrel Systems.

SMART POS

Svend Bramsoe

5201 S Fox St

Littleton, CO 80120

303-309-1218

info@smarterpos.net

https://www.smarterpos.net/lets-talk/

What to Look For In a Great POS CC Processor

What is a POS CC processor?

A point of sale credit card processor is a tool that can help you boost your customer base by providing the customer with several payment options. The device accepts payment through credit cards and in return, creates an invoice that indicates that the customer made a payment. It also keeps a record of the company’s daily sales.

Five Things To Consider When Looking For A Great POS CC Processor

Before you jump in to getting your business a POS CC processor, consider a couple of essential features that a great POS credit card processor should possess.

1. Payment Method Coverage

If you want to increase your customer base, then the prime factor is to expand your payment method coverage. Not every customer has a credit card; some might have a debit card. Make sure the POS CC processor accepts both.

Also, the growing technology has turned consumer attention towards having digital wallets instead of cash in hand. Therefore, check if your POS CC processor accepts e-wallets or not, otherwise, you might lose a good amount of customers.

2. Customer Support

When purchasing a POS CC processor, make sure the provider’s respective representatives are available 24/7 – not virtually but physically.

You never know when the processor starts acting up and causes your company a huge loss financially. The loss can be even bigger if a POS malfunction happens during the peak hours of your business. An immediate connection with the processor provider will fix the problem, and save your company from a sudden breakdown.

3. Security Tools And Fraud Prevention

When it comes to credit cards, the first thought that comes to mind is fraud and theft, and possible measure to prevent it.

To protect your company’s hard-earned cash, look out for a processor that has an in-built security system. Secondly, check for the registration of the processor with “payment card industry data security standard” (PCI-DSS). Lastly, ask the provider if the processor will document, secure, and back up your sales records.

4. Interoperability

Connecting your credit card processor directly with your point of sale system can make business operations a lot easier than before.

The reason is that as soon as a customer makes a payment through a card or electronically, the POS system will update the record purchased item in the inventory. Thus, it will keep the inventory up-to-date without any manual labor.

5. Comparing Cost

Investing new tools in your venture seems progressive until your profit decreases. However, if the tool you have purchased proves to be beneficial and expands the company’s reach, then the money you have spent has produced its value. However, it does not mean that you purchase an overly priced processor. It will prove to be counterproductive.

The best thing to do is to do a prolonged research, compare prices according to the features of each processor, and then make a purchase.

Bottom Line

If you’re still confused, which provider would serve you with the best deal and price of credit card processor, then nothing major to worry. Contact Smart POS and avail yourself to the best deals along with 24/7 customer support.

SMARTER POS

Svend Bramsoe

303-309-1218

Should I use EVO payments as my POS Credit Card processor?

Should I use EVO payments as my POS Credit Card processor? Globalization and technology are making the marketplace more complex. EVO payments helps customers capture the market through affordable solutions that work. Our company’s presence in 50 more than 50 markets and ability to handle over 150 currencies makes us a global leader in point of sales systems.

Why should I accept credit cards?

Credit cards are quickly becoming among the most popular forms of payment. Only 24 percent of Americans use cash in transactions today. Up to 86 percent of all consumers use credit cards. A study by Intuit found that revenue grew for 83 percent of companies after accepting credit cards by as much as $20000 per month.

Credit cards offer a way to avoid the pain of purchasing. Customers spend more when using a credit card, up to $80 more depending on the type of product.

What credit cards does Evo Support?

Evo supports all popular credit card companies. We support Visa, Mastercard, Discover, and American Express. We strive to provide the broadest level of support possible and will work with you to fill your needs.

Can I integrate Evo Payment solutions with my existing products?

As a software company, we seek to integrate our services with your company easily. Whether creating a mobile app, working on your point of sale system, or creating a back-office solution, our products make payment and reporting easy.

Our intelligent platform and omnichannel commerce apps makes payment a snap. We quickly deploy in existing or new applications to provide the most robust solution possible. Through Snap, we offer developers an easy way to customize the payment experience.

In addition to payment systems, we offer best in class APIs built on our partnerships with leading ISOs continues to open new avenues to success. Our solutions are without borders and can help grow your international customer base.

Is Evo secure?

Evo takes great pains to ensure the security of your system. We closely watch transactions for anything that might raise a red flag and act accordingly. Our professionalism leads us to use the best industry practices in development and the deployment of our technology.

Our hardware solutions are equally security minded. Our processors accept pin and chip cards and receipt-less integration with handheld through SecureTablePay allows your company to avoid misplacing receipts.

What equipment is required to use Evo at a retailer?

Evo supplies the equipment required to process credit cards at your business. We make the process seamless. Simply request an account, and we send what you need to your address. If you are not satisfied with our products, submit a cancellation notice and return the equipment.

Can I run a loyalty program with Evo software?

Running a loyalty program through Evo software is possible. Our card processors handle gift cards to help you show appreciation for your customers. We also support direct mail campaigns and a variety of other value-added services through our point of sales systems.

Does Evo offer Support?

Evo offers support for every platform and are available 24/7 to answer any questions you have. Our Microsoft certified support staff can help you resolve problems and deploy our product at your retailer or e-commerce website.

Contact Smart POS today if you are looking to process cards securely. Our customized services aim to provide the solution you need without compromise.

Credit Card Processing for POS Systems

Credit card processing for POS systems is a major concern when considering which technology to use. Credit cards are a significant source of revenue for restaurants. Despite their widespread adoption, merchant fees are already a burden. Being produced by EVO Payment solutions gives Smarter POS access to 150 currencies in a global market.

Credit card processing for POS systems is a major concern when considering which technology to use. Credit cards are a significant source of revenue for restaurants. Despite their widespread adoption, merchant fees are already a burden. Being produced by EVO Payment solutions gives Smarter POS access to 150 currencies in a global market.

How do credit cards affect my business?

Many small businesses and startups have little leeway for fees. Even so, the average merchant fee among credit card processors is typically between 2 and 3 percent of a sale. Clients generally pay a higher cost when using credit.

Despite the additional cost, accepting credit cards drives sales. A survey by Intuit found that 83 percent of businesses saw an increase in revenue after starting to take credit. Fifty-two percent of companies saw an increase of at least $1000 with 18 percent receiving a boost of $20000 each month.

Not only do credit cards broaden the customer base but they lead to increased spending. For restaurant employees and employers, this means that tips often increase as well. The money in their wallet is not limiting the amount your customer spends.

Some credit card companies allow you to negotiate a fee. Many providers offer tiered accounts with lower costs at higher volumes of sales.

Do I need to purchase additional equipment to accept credit cards?

If your hardware does not provide a point of sales system, you need to purchase additional software. This allows you to take advantage of the efficiencies generated by an electronic payment system.

If your hardware does not provide a point of sales system, you need to purchase additional software. This allows you to take advantage of the efficiencies generated by an electronic payment system.

The Smarter POS system offers integrated credit card payments and a variety of features. Our SecureTablePay, operating in over 2000 restaurants, works with more than 20 of the top restaurant management systems. We work with you to increase efficiency and drive sales with whichever provider you choose.

The efficiencies that our system provide are a benefit to both your servers and your bottom line. Efficiency increases the revenue per person per hour while allowing your waiters to handle more tables. The system also closes a sale from the pinpad, avoiding the potential security issues related to credit card receipts.

Alternative options such as Stripe exist. However, obtaining inventory tracking and the power of a full point of sale system means purchasing additional software.

What are the most commonly accepted credit cards?

Businesses in America face a wide variety of options when considering which credit cards to support. Visa, Mastercard, American Express, and Discover are the largest providers. However, banks such as Chase also offer options to qualified customers.

Businesses in America face a wide variety of options when considering which credit cards to support. Visa, Mastercard, American Express, and Discover are the largest providers. However, banks such as Chase also offer options to qualified customers.

Many of the most popular credit card companies require good to excellent credit for your customer to become a cardholder. Companies are as concerned about being paid back as you. This is particularly true if they charge an extra fee to use their systems.

Point of sales systems may charge a fee to access your merchant account. For example, Stripe includes a 2.9 percent processing fee with an additional charge of 30 cents for a successful transaction. These fees often cover the merchant fee and give you access to any other software required to process a credit card.

Credit card processing for POS systems is common. Smarter POS offers superior quality and the prospect of better efficiency. Contact Svend Bramsoe today to find out how our POS systems can benefit your restaurant.

How does a credit card processing work with a POS system?

Credit cards are essential to conducting business but just how does a credit card processing system work with a POS system? These systems offer everything from payment processing to back office management tools. Most POS systems such as Evo’s Smarter POS, offers software and hardware that integrates credit card processing into payment.

Credit cards are essential to conducting business but just how does a credit card processing system work with a POS system? These systems offer everything from payment processing to back office management tools. Most POS systems such as Evo’s Smarter POS, offers software and hardware that integrates credit card processing into payment.

How do POS systems process credit cards?

T he rise of simple off the shelf solutions changed the way that point of sale systems work in the past few years. Small devices and downloadable software allow everyone to obtain payment processing help. Every POS requires specialized hardware to process cards.

he rise of simple off the shelf solutions changed the way that point of sale systems work in the past few years. Small devices and downloadable software allow everyone to obtain payment processing help. Every POS requires specialized hardware to process cards.

Hardware requirements for credit card processing are minimal. A POS needs to have either a card swiper or pin and chip system which allows your system to read a card number and send information to a provider.

If your payment processor is plug and play, additional software is almost always required to contact a credit card company and verify your merchant account. This brings the cost of a simple processor up to that of an inclusive system.

How much does a credit card processor cost?

Credit card processors are inexpensive. They run from $59 for a small plug and play device to $500 for a larger handheld system that incorporates the entire payment processing system.

Higher priced options offer more features. Low cost options require additional software, costing up to $500 for the capability to complete a sale. Other options, costing roughly the same, complete a sale on the device in secure and efficient way.

Why should I use a credit card processor?

Credit cards increase revenues. An Intuit study found that 83 percent of businesses starting to accept credit cards saw an increase in income by as much as $20000 per month. Fifty-four percent of businesses saw an increase of at least $1000 each month.

Payment processing software requires a merchant account. Credit card providers charge a one-point-five to three percent fee for each purchase. However, customers tend to spend more when using credit cards, as much as $80 more depending on the item.

What credit cards does a POS system accept?

Credit card companies need to be reputable and easy to work with. To ensure ease of use and security, POS companies support the most popular cards. American Express, Discover, Visa, and Chase are among the most common options today.

Smarter POS and Snap by Evo accepts these major carriers. However, our system is customizable and we will work with you to provide the most extensive solution possible.

How can I ensure that my credit card processor is secure?

Identity theft is a major issue for POS systems and credit card providers. Fraudulent and stolen cards cost consumers as much as $16 billion each year. A breach costs trust in your business.

Identity theft is a major issue for POS systems and credit card providers. Fraudulent and stolen cards cost consumers as much as $16 billion each year. A breach costs trust in your business.

Smarter POS and other systems offer chip and pin processors and other modern features to give customers peace of mind. SecureTablePay also offers tableside payments which reduce the visibility of a credit card number and work to increase efficiency and even reduce paper waste for businesses. All trusted systems and processing software encrypt data.

Still, it is also necessary for stores to provide a secure environment. This means following appropriate guidelines for password protection and networking hardware. Evo offers 24/7 customer support from certified Microsoft professionals to help you get started.

If you are wondering just exactly how does credit card processing work with a POS system, Svend at Smart POS can help. Our simple registration, setup, and cancellation processes can help drive your revenue. Contact us today.

Smart POS

Svend Bramsoe

303-309-1218

www.smarterpos.net

I just opened a retail store. How do I process Credit Cards?

Retail stores feel the pressure to increase their bottom line more than any other industry. One of the easiest ways to improve your bottom line is to process credit cards. Smarter POS offers easy and integrated solutions to help retailers process credit cards.

Retail stores feel the pressure to increase their bottom line more than any other industry. One of the easiest ways to improve your bottom line is to process credit cards. Smarter POS offers easy and integrated solutions to help retailers process credit cards.

How can processing credit cards improve my revenue?

Credit cards are more prevalent than cash today. Intuit found that 83 percent of businesses surveyed saw a revenue increase after accepting credit. This bump in revenue was as high as $20000 per month with fifty-two percent of those surveyed seeing a rise of at least $1000.

People are more likely to use credit cards than cash. Only 24 percent of consumers purchase everything with fiat money. While not small, at $2.3 trillion in total, this was only double the total amount of credit card debt. 86 percent of Americans claimed that they used cards at least some of the time.

This is particularly true for high value restaurants and retailers. The larger the transaction, the more likely a customer is to use credit cards.

How do I process credit cards?

Credit card processing requires a terminal and secure connection to your accepted providers. Accounts with these companies are required to accept cards. Merchant fees of 2-3 percent are usually applied for each transaction and are paid directly to the credit company.

Equipment to process cards can be used at the register or may be mobile. Smarter POS offers handheld devices through SecureTablePay that gives your employees freedom of movement.

Do people spend more when they use credit cards?

Customers spend more on average when using credit cards. The average cash purchase is only $22 compared to $112 for non-cash transactions. Credit cards tend to increase the amount spent in cash purchases as well as the average amount spent in a mixed transaction was $84.

Credit card providers make spending incredibly easy. These companies provide incentives such as airline mileage or money back that makes them lean towards their card over anything else in their wallet. Experts refer to these incentives as easing the pain of paying.

Do point of sale systems accept credit cards?

Most point of sale systems accept credit cards. They may also charge an additional fee for their usage. Of the major systems, each one accepted credit. Many limit credit card purchases to a specific set of companies.

Most point of sale systems accept credit cards. They may also charge an additional fee for their usage. Of the major systems, each one accepted credit. Many limit credit card purchases to a specific set of companies.

Smarter POS works with you rather than against you. Our customized and off the shelf solutions aim to provide as much access as you need to the most popular cards. We also handle loyalty programs and gift cards to allow you to show appreciation for your customer base.

Are there security risks to accepting credit cards?

There is a risk of identity theft when using a credit card. However, retailers are not greatly affected by this form of fraud. Instead, consumers are hit with up to $16 billion in fraudulent purchases each year.

There are ways to give your customers peace of mind and increase their trust in your company. This includes accepting pin and chip transactions and minimizing the use of receipts for credit card purchases. Smarter POS allows your customers to complete transactions at the register and integrates the most modern security solutions for your convenience.

If you opened a retail store and are asking how do I process credit cards, contact us at Smart POS today. Serving greater Colorado, the midwest, and the USA.

References

Campbell, Anita. Cash Isn’t Always King: Accepting Credit Cards Can Increase Your Business. (28 January 2019). Available at https://smallbiztrends.com/2013/07/accepting-credit-cards-increase-business.html

Sirull, Ellen. Cash vs. Credit Cards: Which Do Americans Use Most? (18 June 2018). Available at https://www.experian.com/blogs/ask-experian/cash-vs-credit-cards-which-do-american-use-most/

When Do Small Businesses Need to Upgrade POS Systems?

When Do Small Businesses Need to Upgrade POS Systems?

Small businesses often forgo making upgrades to their POS system for various reasons. It may not seem like a necessary investment. It may seem to be an expense you do not need because everything is working just fine now. As a small business owner, you can benefit from upgrading your POS system every few years, especially if you have not done so in some time. It does not have to extensive or expensive, but it can provide a number of key benefits to your company. There are various reasons to make your decision to upgrade and they all stem from the tools newer POS system can offer to you.

What Can a New POS System Do for You?

POS system upgrades can provide a range of services and even customization for many of today’s small business owners. If you are unsure if you can benefit, consider a few key reasons to do so by looking at the advantages new products and features can offer to you and your business.

Improve the ease of use of your system. This is important today from all vantage points. Employees want an easy to use system, as do your back of the house team. And, even your customers want and expect an easy credit card processing system.

Keep costs in line and even lower. Newer POS systems can actually be more affordable to you. Look for a service that offers simple pricing and even services like pay as you go. The key here is to ensure the pricing is transparent and clear, which helps you with budgeting and profit managing.

Data security is improving. This is a growing importance for nearly all business owners. As a business owner, you need to ensure the POS system’s data is always as secure as possible. This includes security for the business and for those customers.

In addition to these benefits, look for a POS system that provides even more. They should offer outstanding reporting tools and data accessibility that allows you to log in from any internet based location to gather information. You also want a system with quality hardware that can handle ongoing use. It does not have to be hard to find such a tool. When you contact and work with our POS system consultant in Colorado, you can customize a solution that fits your needs.

Take a few minutes to contact us at 303-309-1218 to learn more about a better point of sale system for your business.

Is a Virtual POS System Ideal for You?

Is a Virtual POS system something your business should implement? For many of today’s businesses, the thought of changing out a POS system is overwhelming. With so many reasons to upgrade, though, it pays to learn all you can about your options in doing so. One of the options you may wish to consider is the use of a virtual POS system. Have you heard of how this can change the way you do business? Take a closer look at what this type of system is and what it can mean to your existing POS system.

Is a Virtual POS system something your business should implement? For many of today’s businesses, the thought of changing out a POS system is overwhelming. With so many reasons to upgrade, though, it pays to learn all you can about your options in doing so. One of the options you may wish to consider is the use of a virtual POS system. Have you heard of how this can change the way you do business? Take a closer look at what this type of system is and what it can mean to your existing POS system.

What Is a Virtual POS System?

A virtual terminal is a type of POS system that is being implemented in a wide range of merchant stores today. It offers a number of different benefits to business owners. It is, simply, a web version of the physical credit card terminal you may have in place. In other words, it is a web based POS (Point of Sale) system. What does that mean for you and your business? A virtual terminal is a type of software application that is hosted online. It is generally hosted by your service provider’s servers. And, it can be a very safe and secure way to process payments. Because it is virtual, it offers one of the best benefits possible. That is, it can be accessed from just about any web browser connected to the internet. How does this impact you?

There are various reasons why you may wish to ensure your POS system offers this type of connectivity. This type of terminal will give your business the ability to input your customer’s credit card information into the payment form – which is also web based. This is then used to create an electronic transaction. The system works much the same as a traditional payment, but it gives you the ability to transact over the internet, giving you more access to your customer base.

There are various reasons why you may wish to ensure your POS system offers this type of connectivity. This type of terminal will give your business the ability to input your customer’s credit card information into the payment form – which is also web based. This is then used to create an electronic transaction. The system works much the same as a traditional payment, but it gives you the ability to transact over the internet, giving you more access to your customer base.

If your business conducts any type of activity online or over the internet (including from mobile payments and purchases) it may be time to consider an upgrade of your POS system to a virtual terminal. Even those organizations that may not have this type of element can benefit from such an upgrade both for current benefits and future use as well. Take a closer look by contacting our POS system consultant in Colorado.

Take a few minutes to contact us at 303-309-1218 to learn more.

Why Your POS System Impacts Your Customer’s Satisfaction

It is easy to overlook the importance of upgrading your POS system. After all, it seems like a complete backhouse problem. It does not impact your ability to conduct business even though it may have a few quirks within it. But, what many people do not realize as small business owners is that their POS system actually provides a great deal for the customer. How is your customer satisfied with what you have to offer based on your POS system? Take a closer look.

Is Your POS System Doing All It Can?

Most of today’s small and medium business owners will see a significant improvement from their business operations if and when they upgrade their existing systems into something new. There are various ways your business may be better offer with a few upgrades.

Do you offer your customers mobile payments? If not, then this may be one of the easiest ways to impress them. Mobile payments allow consumers to step up to your pay point and pay with their mobile device. This is not only a more convenient way for your customers to pay but it can add a layer of security as well.

Be sure you are meeting EMV requirements. New POS Systems simply must have EMV in place at this point, but most merchants are still behind. You’ll want to install this tool into your system to allow for credit cards with EMV chips. If you fail to do this and a fraudulent act occurs, you will face losses. Customers want to know you are up to date and protecting them as well.

Loyalty programs are another fantastic tool to offer your customers. These not only help your customers to build their brand awareness with you but it gets them back in the door time and time again to use your services or buy your products.

There are many other ways that your updated POS system can make a big difference. For example, ensuring it is fast enough is important to ensure that transactions move faster. You’ll also want to consider upgrades that provide more customer insight so you can make better decisions about how to market to your customers. When you work with an experienced team like our own, you can ensure your updated POS system really meets your needs and those of your customers’.

Do You Have a Loyalty Program Yet?

Have you thought about just how hard it is to get customers in your door? Perhaps your customers come back frequently to make the same purchase over and over again. Perhaps they only need your services rarely. In either case, there are key advantages to empowering your customers to keep them coming back. You need a way to remind them of the fantastic product or service that you have to offer. You want them to remember you solved their problem, saved them money, or worked to better meet their unique needs. A loyalty program can do that for you.

Have you thought about just how hard it is to get customers in your door? Perhaps your customers come back frequently to make the same purchase over and over again. Perhaps they only need your services rarely. In either case, there are key advantages to empowering your customers to keep them coming back. You need a way to remind them of the fantastic product or service that you have to offer. You want them to remember you solved their problem, saved them money, or worked to better meet their unique needs. A loyalty program can do that for you.

How Can You Benefit from a Loyalty Program?

A loyalty program is a simple way to remind and engage with your customers after they have left your business establishment. Nearly any type of small to medium business can affordably put in place this type of tool. It is done through your POS system. Once in place, it allows your customers to sign up to communicate with you and enables your business to entice them to come back in. There are numerous benefits to a tool like this and it may be one of the best ways you increase your business’s customer count.

- Everyone likes getting a deal. With loyalty programs, you offer your customers a savings for joining and maintaining their membership. Grocery stores benefit from this by offering cheaper prices to members. It brings members back more often.

- If you have a great deal of competition, the loyalty program can be an empowering way to stand out. For example, perhaps you are a local hardware retail location competing with the big guys down the street. By offering a loyalty program, something the big company is not, you give your customers a reason to come to you over the competition.

- Loyalty programs also allow you to gather data on your customers and their buying habits. You can learn what they buy, when, and why. This allows you to make better inventory decisions.

If you do not have a loyalty program in place, it may be time for an upgrade of your POS system to incorporate one. They can be simple and straightforward.

If you do not have a loyalty program in place, it may be time for an upgrade of your POS system to incorporate one. They can be simple and straightforward.

Work with our POS system consultant in Colorado to learn more about how you can upgrade your credit card processing and POS system to better reflect your needs for these tools.

Call us at 303-309-1218 to schedule a consultation.